Have you found yourself depending too much on credit cards and enjoying the “freedom” of buy now, pay later?

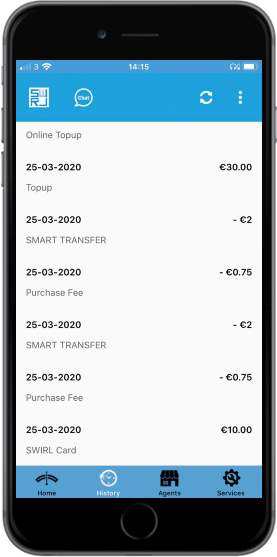

If so, then maybe it’s time you started thinking about getting a SWIRL Prepaid Mastercard. Although you may enjoy the convenience of having a credit card, your spending can quickly spiral out of control. So if you’re feeling the pressure of growing debt, now is a great time to break free with SWIRL Mastercard.

| Credit Card | SWIRL Card | |

|---|---|---|

| Stamp Duty | €30 p.a. on regular credit card. | Max charge of €5 on SWIRL Mastercard; save €25 |

| Interest | Average balance on an Irish Credit Card is €1,600. Interest is paid at a rate of 18% which means you would pay an average of €288 interest p.a. on a credit card. | SWIRL is a Prepaid alternative to a credit card. You can’t run up any debt so you never have anything to pay interest on! |

Impulse Purchases | Late night ATM withdrawals, shopping online, nights out on credit can be dangerous when you use a regular credit card. | With SWIRL Prepaid Mastercard you can only spend what you load so if you have no money on the card you can’t spend it. |

Late Payment Fees | Increased interest charges, high & immediate interest rates for ATM withdrawals. | Avoid these fees and punitive interest charges by using a SWIRL Prepaid Mastercard. |