How to Use Revenue's Small Benefit Scheme to Maximise Tax Savings with Swirl Card Rewards

As an employer optimising tax savings while rewarding your staff is vital. One effective method to achieve this is using Revenue’s Small Benefit Scheme in combination with Swirl Gift Cards. Swirl Gift Cards offer a great opportunity to employers who want to make use of the Small Benefit Scheme to ensure they are getting the most out of their employee rewards programmes, saving money for both company and employee.

Understanding the Small Benefit Scheme

The Small Benefit Scheme, introduced by Revenue, allows employers to provide non-cash benefits to employees up to a certain value without incurring tax liabilities. Currently, the threshold for this exemption is €1000 per employee per annum. This means that employers can offer rewards such as gift cards, vouchers, or other non-cash benefits up to €1,000 without the need for employee PAYE, PRSI, or USC deductions. It’s a win-win situation for both employers and employees, providing tax-efficient rewards while boosting morale and motivation within the workforce. To learn more about Revenue’s Small Benefit Scheme, you can visit their website here or read our 2024 guide here for more information regarding compliance.

How Much Can You Save Through the Small Benefit Scheme?

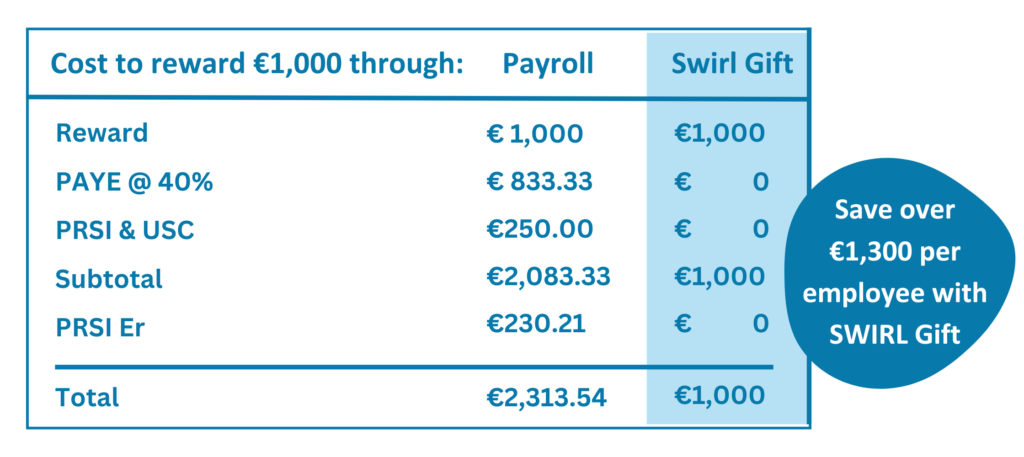

The Small Benefit Scheme gives businesses the opportunity to save a lot on tax payments when compared to cash/payroll payments. The table below illustrates exactly how much your business can save by using the Small Benefit Scheme.

As you can see, to pay an employee €1000 through payroll it would accumulate a total of €1,313.54 in tax liabilities between PAYE (higher rate), USC and Employers PRSI. This means that a payment of €1000 to an employee would end up costing the employer €2313.54. In contrast by making use of the Small Benefit Scheme and SWIRL Gift, the same payment incurs no tax liabilities and so only costs the business the €1000 that they are gifting to their employee. This is a significant saving of €1,313.54 per employee and depending on the number of employees you have, the savings can quickly add up.

Aside from Tax Savings, why should you choose Swirl Gift Cards for your Employee Rewards?

Versatility:

Swirl Gift Cards offer flexibility, allowing recipients to choose the rewards that best suit their preferences and interests. Our gift cards can be used at over 45 million online and retail locations in over 200 countries, ensuring there is something for everyone.

Easy Ordering:

With Swirl, employers can easily order their employee Gift Cards through our online platform. Our simple process is made up of a 1 page order form. Payment can be made by IBAN or debit/ credit card.

Reliability:

We understand the importance of timely and reliable delivery. With Swirl, your cards will be dispatched as soon as we have received your funds, resulting in swift delivery via An Post or Courier.

Corporate Rewards with Swirl Gift Cards

To take full advantage of the tax-saving benefits offered by Revenue’s Small Benefit Scheme and Swirl Gift Cards, we encourage employers and business owners to explore our corporate reward options. Whether you’re planning an employee appreciation event, recognising significant milestones or celebrating achievements, Swirl Gift Cards provide the perfect solution for rewarding your hardworking team members.

Ready to Reward your Team ?

Make an Enquiry

Make an Enquiry

Check out some of our other Corporate Blog posts below!

Boost Staff Performance with Employee Gifting

Impact of Rewards on Productivity: Boosting Performance with Employee Gifting...

Read MoreThe Evolution of the Christmas Bonus: Insights for Employers

The Evolution of the Christmas Bonus: Insights for Employers Over...

Read MoreUnlocking the Benefits of Tax-Free Bonuses in Ireland: Your Ultimate Guide

Tax-Free Bonus in Ireland: Maximising Rewards with SWIRL Gift Cards...

Read MoreEasy Employee Christmas Gift Cards with SWIRL Rewards: A Stress-Free Solution for Corporate Gifting

The Evolution of the Christmas Bonus: Insights for Employers Over...

Read More