How to Get a Free SWIRL Card: A Guide to Financial Planning

In today’s fast-paced digital world, having a secure and convenient way to manage your finances is crucial. Whether you’re shopping online, budgeting your expenses or avoiding debt, our SWIRL Prepaid Mastercard is the perfect tool to help you stay on top of your financial game. Our helpful guide will walk you through the process of getting a free SWIRL Card and demonstrate how much of an asset it can be when planning your finances and avoid a complicated credit card online application.

The Importance of Financial Planning

Financial planning is more important now than ever with the current cost of living crisis. According to a survey by the National Financial Educators Council, 78% of adults live paycheck to paycheck, proving there is a need for more effective money management. Our SWIRL Card offers a unique solution, providing a safe and secure method for online shopping and budgeting, without the risk of falling into debt.

What is a SWIRL Card?

A SWIRL Card is a prepaid Mastercard that you can use for online shopping, in-store purchases , and ATM withdrawals worldwide. Unlike traditional credit cards, the SWIRL Card allows you to load money onto the card beforehand, ensuring you never spend more than you have.

Benefits of having a SWIRL Card

Safe and Secure Online Shopping:

Prepaid cards add an extra layer of security when you shop online as you can use a dedicated card instead of your main bank account which can help protect your funds from scams and phishing.

Budgeting:

Keep your funds separate from your main account to manage your expenses better. This separation of funds has helped so many people to budget more efficiently and without the stress of overspending. SWIRL Prepaid Mastercard is a highly effective tool for budgeting. By allowing individuals to load a specific amount of money onto their card, it ensures spending limits are set and adhered to. This makes it easier to allocate specific budgets for different expenses, such as groceries, entertainment or travel, enhancing financial discipline. Additionally, the ability to track spending through the SWIRL App provides real-time insights into where money is going, helping users adjust their habits and make informed financial decisions.

Avoid Debt:

You can only spend what you have topped up on a SWIRL Prepaid Mastercard, meaning there is no overdraft or credit options available. This can help you avoid running into debt as you can only spend what you load onto the card. It is perfect for anyone who has a habit of overspending and does not want go through the credit card online application process.

Accessible for the Un-banked:

If you are looking for an alternative to an online credit card application without the stress of being denied, SWIRL Card is the solution for you. Our cards are an ideal money management solution for those who are new to the country or don’t have a traditional bank account.

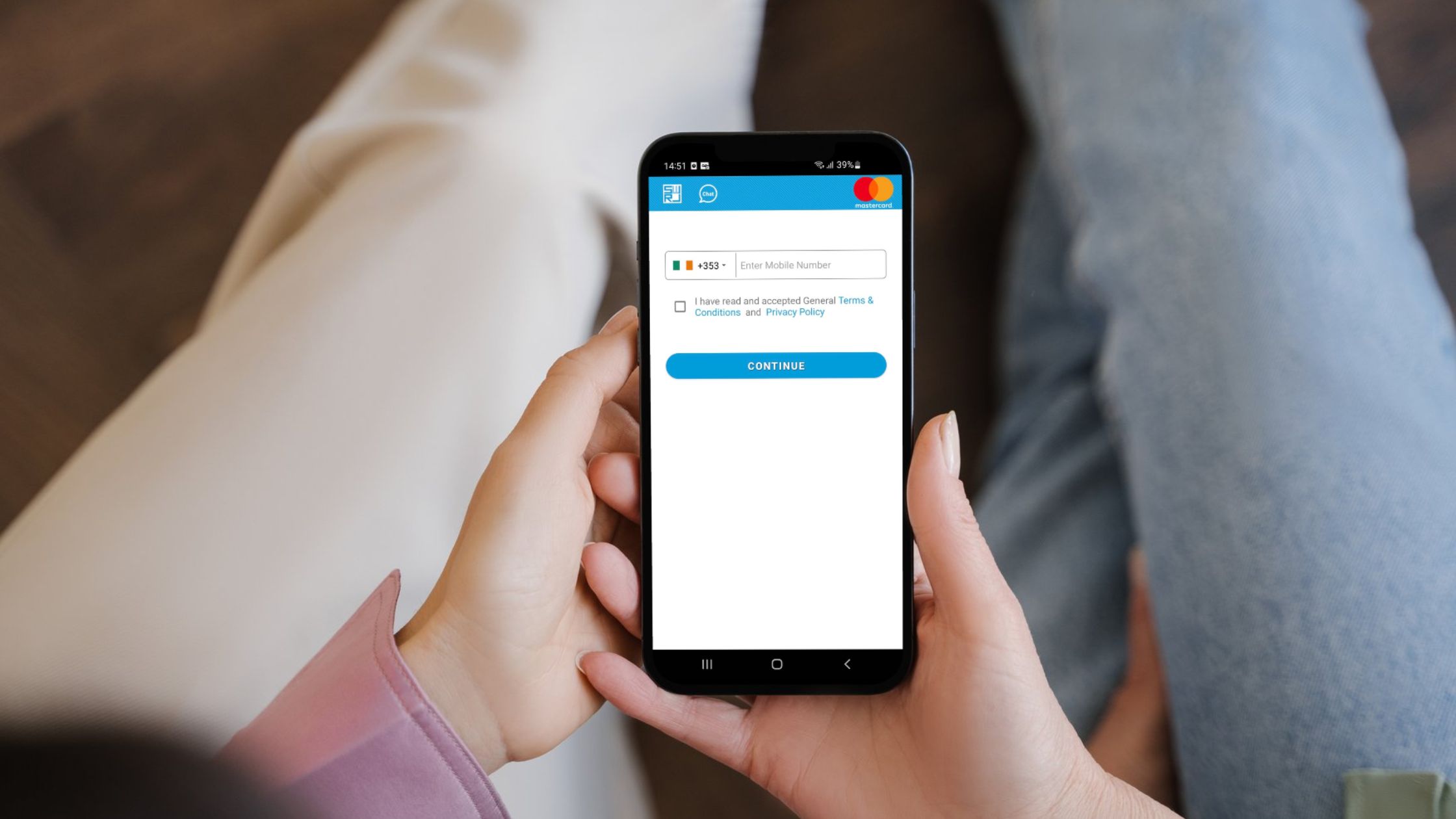

Quick Registration and Money Management:

Download the SWIRL App and complete the in-app registration in just a few minutes and you will have your SWIRL Card within a few days. It’s that easy. Gain 24/7 access to your balance, transactions, top-ups and gain access to your virtual card instantly.

Why Choose a SWIRL Card for Financial Planning?

Our SWIRL Card is more than just a prepaid card. It’s a tool designed to help you take control of your finances. Here’s why it’s an excellent choice:

Security:

Using a separate card for online purchases minimizes the risk of scams and phishing. SWIRL Card helps protect your bank account from such threats.

Budgeting:

The SWIRL Card makes budgeting easy. Load only what you intend to spend, ensuring you stay within your financial limits. This approach helps in tracking expenses and avoiding overspending.

Accessibility:

For those new to the country or without a traditional bank account, the SWIRL Card provides an accessible alternative. It can be topped up with cash at Payzone stores across Ireland or via bank transfer and debit card in-app.

Debt-Free Spending:

Since you can only spend what you load, the SWIRL Card eliminates the risk of debt. This is particularly beneficial for those who prefer to avoid credit cards and their associated interest rates.

Encouraging Financial Literacy:

At SWIRL, we believe in empowering our customers with the knowledge to make informed financial decisions. Our blog features a wealth of information on budgeting, saving , and simple but effective ways to get the most out of using our cards to their full potential.

Obtaining a free SWIRL Card is much easier and quicker than a credit card online application and is a simple step towards better financial management. By using a prepaid card, you can enhance your budgeting, secure your online transactions, and avoid debt. Visit www.swirlcard.com today to apply online for your credit card and start your journey towards financial freedom.

Check out some of our other SWIRL Prepaid Mastercard Blog Posts Below!

4 Tips to Unlock Mid-Term Adventures in Ireland with SWIRL Mastercard

Planning an quick adventure with friends & family during the...

Read MoreAvoid Carpark Ticket Machine Scams: Secure Payments with SWIRL Mastercard

Stay protected from parking machine scams with a SWIRL prepaid...

Read MoreHow to Build Your Emergency Fund with a SWIRL Prepaid Mastercard

SWIRL Prepaid Mastercard is the perfect solution to building savings...

Read More7 Ways to Keep Your Money Safe and Avoid Scammers with SWIRL Card

At SWIRL Card, we prioritize your security by offering robust...

Read More